Does Uk Tax Gambling Winnings

Ah the tax man, everyone’s favourite person to hate. The guy or girl who makes sure you pay your share to keep the country running. Even though we all pay our tax knowing that the money is going to fund important services like the NHS, the police, and others, it still stings when we look at how much of our paycheck never reaches our pocket.

Also, in the UK money from spread betting is considered gambling; if I maintain a UK spread-bet account will I have to pay Swiss taxes on this? Thanks in advance. Gambling and Taxation. Essentially betting is ‘tax-free’ in the UK – the professional gambler is outside the scope of tax. This is confirmed in HMRC’s Business Income Manual at BIM22015. The basic position is that betting and gambling, as such, do not constitute trading. This is not a new precedent either. Gambling winnings aren’t taxable in the UK. While other countries will tax anywhere between 1% and 25%, the UK won’t care if you’ve won £10 or £10.000.000. No matter what kind of gambling you’re doing from bingo to horse racing and everything in between, there will be no gambling winning tax in the UK. The other reason the UK government does not charge gambling winnings tax is because it does not consider gambling a trade. If the UK government treated gambling as a form of trade, and therefore a taxable income, then punters would be able to claim losses in their tax return.

The world of tax can be a baffling place when you start looking into the various loopholes, tax breaks, and tax free earnings allowances that are out there, but luckily most people never have to worry about it because it is all taken care of at source.

But what if you have a good day at your online casino and manage to bag a big win? Is the tax man going to come knocking on your door? This short article will explain all.

Gambling Winnings in the UK

If you are reading this because you have just won a lot of money then I have more good news for you – all of that money, every single penny, is tax free. You don’t even have to declare the winnings.

Does Uk Tax Gambling Winnings 2019

That’s correct, nobody pays a penny in tax on gambling winnings in the UK, so whether you win a fiver or £500k it is all yours to do with as you please. This goes for occasional players, hobbyists, and professional gamblers who make a living from online casinos – it is all tax free.

It might be a surprise that the authorities are skipping this opportunity to take some extra dosh from the population, but it’s not really an act of benevolence, it would just be incredibly difficult for them to do it with the current tax system, and anyway, they have ensured that they get their end in another way.

Taxed at Source

Up until 2001, bettors did have to pay tax when they gambled and they could choose whether to pay it on their stake or their winnings before they made the bet. This had been the case since the 60s so it didn’t really effect online casinos as they were only just becoming a reality when the tax was abolished.

In 2001, the government started charging the bookmakers and casinos 15% on profits and scrapped the betting levy in an attempt to stop the mass exodus to places like Malta and Gibraltar, where betting companies could take advantage of lower business rates and still offer remote services to the UK. This way, the treasury still got paid but the operators took the hit, and any winnings were tax free. Of course, the operators will have adjusted their prices and payout rates to compensate for this so in effect the customer does still pay, but it isn’t as apparent.

Unhappily for the government, and unsurprisingly for everyone else, this didn’t do anything to coax back those companies that had already left, and in fact even more of them packed their bags and relocated. Then in 2014 the Point of Consumption tax was rolled out, which meant that wherever the company was based they would still have to pay 15% on every bet they took from the UK. This is the way things work to this day, except the rate was increased to 21% in 2018; so the operator pays 21% on every bet you make on a slot, horse, card game, or football match.

Income from Winnings

While the winnings are tax free, what you do with them might not be.

If you win enough to retire on and just leave it sitting in your bank account then you don’t really need to worry unless you are earning ridiculous amounts of interest that could be taxable.

However, if you use your winnings to try and make more money then you will probably find that tax will be due on any money you make. People who win large sums often come up with a plan to make the money work for them, and if you are the same then you will have to pay tax on things like:

- Property

- Investments

- Business Income

- Inheritance Tax

The best way to think of it is that your winnings are only tax free once. Whatever you do with it after the money lands in your account will be liable for tax just like anything else.

So if you invested £10,000 and the next year that investment was worth £12,000, you would need to pay tax on that extra £2,000.

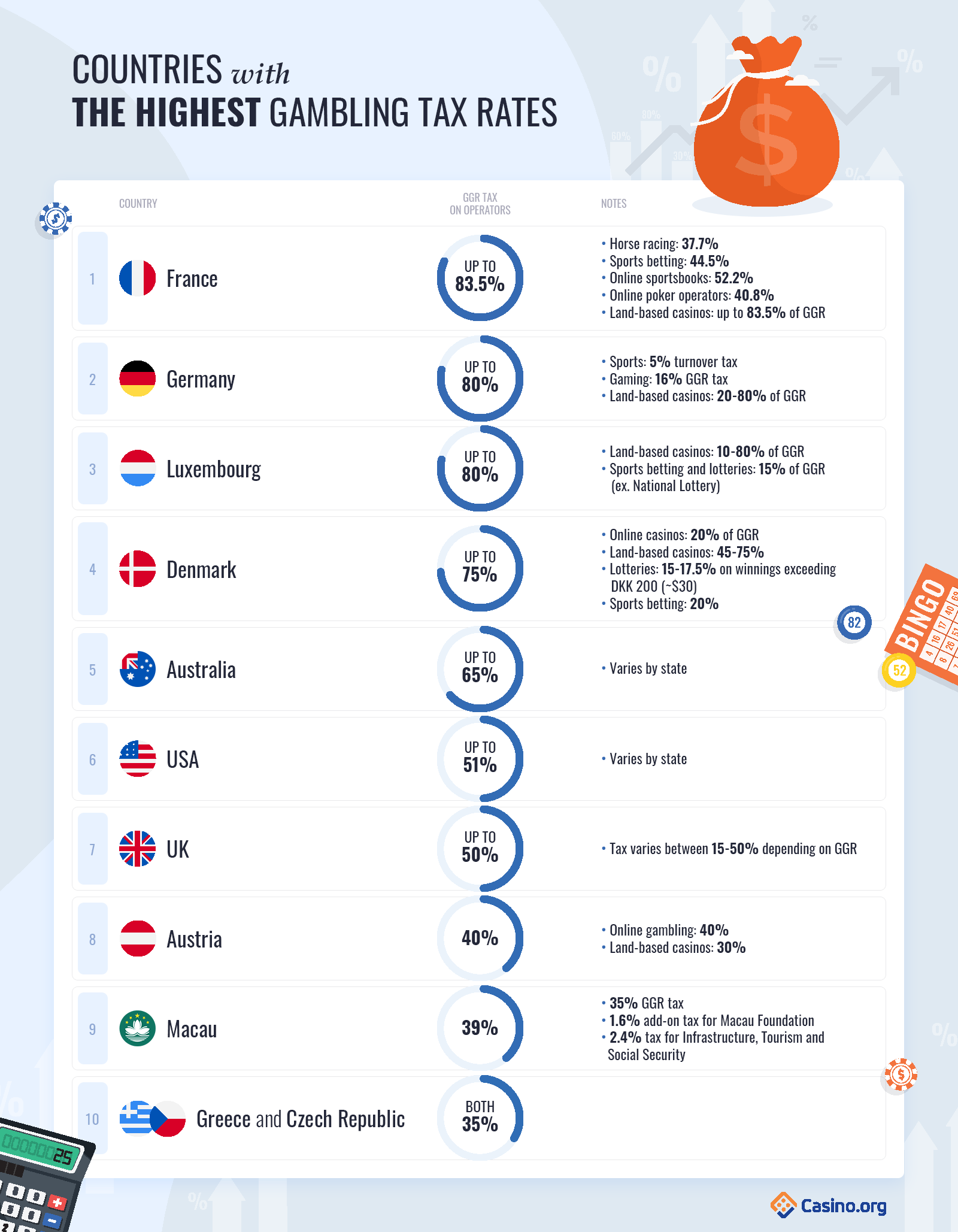

Gambling Tax in Other Countries

We have actually got it pretty good over here in the UK. We might have some of the longest working hours in Europe but when it comes to gambling winnings we have struck it lucky.

Here is how a few other countries compare:

| Country | Operator Tax | Winnings Taxed? |

|---|---|---|

| UK | 15% | No |

| Czech Republic | 23%-35% | Yes |

| Greece | 35% | Yes |

| Italy | 22% | Yes |

| Netherlands | 29% + 2% | Yes |

| Sweden | 18% | No |

Does Uk Tax Gambling Winnings Money

So there you go, count yourself lucky you don’t live in Greece!